Closing Entries in Accounting: Everything You Need to Know +How to Post Them

All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year. Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called the income summary account.

What are Temporary Accounts?

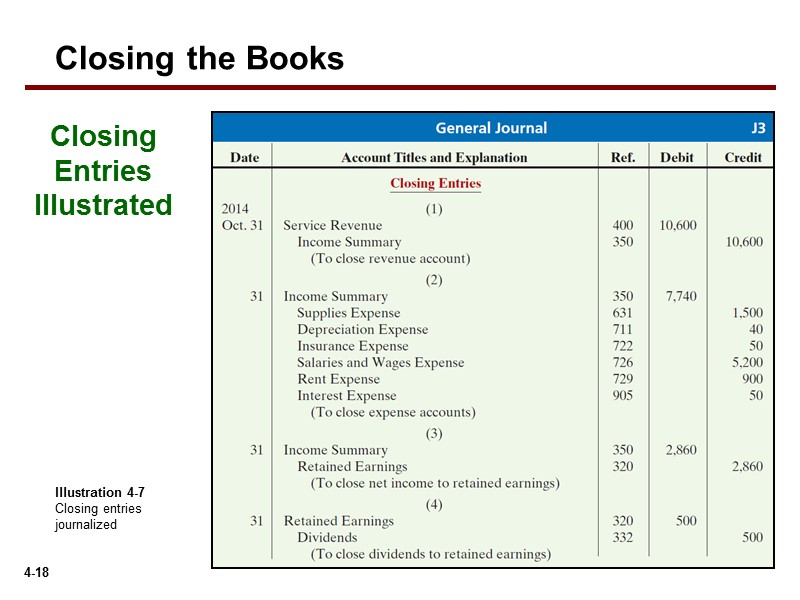

These journal entries are made after the financial statements have been prepared at the end of the accounting year. A closing entry also transfers the owner’s drawing account (a temporary balance sheet account) balance to the owner’s capital account. The closing entries will mean that the temporary accounts (income statement accounts and drawing account) will start the new accounting year with zero balances. A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. These accounts must be closed at the end of the accounting year.

Do you own a business?

Closing entries are crucial for maintaining accurate financial records. HighRadius has a comprehensive Record to Report suite that revolutionizes your accounting processes, making them more efficient and accurate. At the core of this suite is the Financial Close Management solution, which simplifies and accelerates financial close activities, ensuring compliance and reducing errors. Do you want to learn more about debit, credit entries, and how to record your journal entries properly? Then, head over to our guide on journalizing transactions, with definitions and examples for business. Thus, the income summary temporarily holds only revenue and expense balances.

How to close revenue accounts?

This is an optional stepin the accounting cycle that you will learn about in futurecourses. Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7were covered in The Adjustment Process. Adjusting entries are used to modify accounts so that they’re in compliance with the accrual concept of recording income and expenses. We at Deskera offer the best accounting software for small businesses today.

- Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries.

- To close expenses, we simply credit the expense accounts and debit Income Summary.

- By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings.

- A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary.

- Dividend account is credited to record the closing entry for dividends.

The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period. Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period.

The remaining balance in Retained Earnings is $4,565 (Figure 5.6). This is the same figure found on the statement of retained earnings. Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity. These accounts will not be set back to zero at the beginning of the next period; they will keep their balances.

Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. However, most companies prepare monthly financial statements and close their books annually, so they have a clear picture of company performance during the year, and give users timely information to make decisions. In a computerized accounting system, the closing entries are likely done electronically by simply selecting “Closing Entries” or by specifying the beginning and ending dates of the financial statements. As a result, the temporary accounts will begin the following accounting year with zero balances. In order to produce more timely information some businesses issue financial statements for periods shorter than a full fiscal or calendar year. Such periods are referred to as interim periods and the accounts produced as interim financial statements.

In step 1, we credited it for $9,850 and debited it in step 2 for $8,790. To close expenses, we simply credit the expense accounts and debit Income Summary. Prepare the closing entries for Frasker Corp. using the adjusted trial balance provided. The income statement summarizes your income, as does income summary.

Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Closing entries are put into action on the last day of an accounting period.

The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary. We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period.

The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings. We do not need to show accounts with zero balances on the trial balances. Closing entries, also xero on pc called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year.